How to amend your profile for FBR return filling?

How to amend your profile for FBR return filling? In this article we will discuss how a FBR tax filler can amend his person details e.g Mobile number, email, residence address , bank account etc.

HOW CAN YOU CHANGE YOUR PERSONAL DETAILS FOR FBR RETURN FILLINGS? (amend your profile for FBR return )

A person can change their registration information recorded for filing Income Tax Return in three (3) possible ways.

- Changing information through Iris, a person can change/update information by logging into Iris.

Following information can be updated by the person through Registration Form 181 (filed for modification) Income Tax:- Mobile number

- Personal/Residential Address

- Business Address

- Addition of Business Branches

- Legal Representative u/s 87 of Income Tax Ordinance 2001

- Bank Account

Changing information through Federal Board of Revenue (FBR) helpline (amend your profile for FBR return )

A person can also change or update information through FBR helpline via phone or email.

Following information can be updated through the helpline:

- Name

- Date of Birth, Gender, Disability Status

- Senior Citizen Status

- Changing Information by visiting Regional Tax Office (RTO)

For changes in registration regarding the following issues, the person will have to visit their relevant RTO:

- Discontinuance of business

- Jurisdiction for Income Tax Return assessment

- Deregistration Updating CNIC number

- Updating Pakistan Origin Card (POC)

A person will have to take relevant documents to RTO in order to successfully change details regarding Income Tax Registration.

Must read:

https://accountsgala.com/understanding-the-nbp-student-loan-scheme/

What will happen in case a FBR tax filler forget his Password and has changed is mobile number ?

Now this a very tricky question as the tax filer want to login his profile through iris portal at FBR to either file his returns or to update any thing in his profile.

In order to update new password in a tax filer forgot his FBR IRIS Login password you must know your valid email address and also have the mobile number updated in FBR record in order to receive the secret PIN code received on registered email and mobile phone number with fbr.

In case you want to update your new mobile number at FBR record then you may do so by visiting Regional Tax Office (RTO) and after fulfilling certain paper work formalities you may get your new mobile number updated to get your password reset later on by logging in to the FBR iris portal .

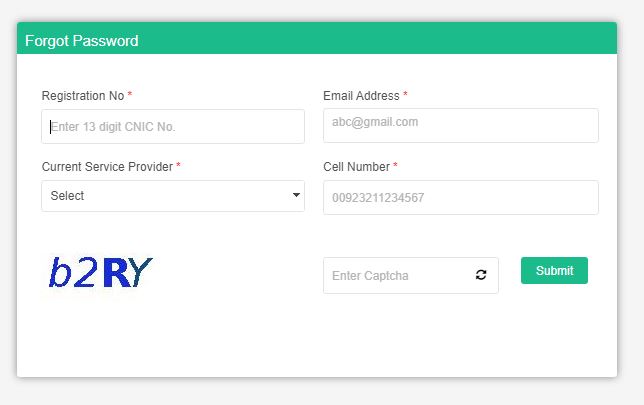

Once you visit fbr iris web portal and click FBR password button through given link https://irisv1.fbr.gov.pk/user/forgot-password.xhtml below appended screen will appear where you need enter the desired information and press the submit button to proceed further to set up your new iris user password as desired .