An Insight into a Joint Bank Account

An Insight into a Joint Bank Account: Joint bank account’s are of great significance as they give you liberty to manage your financial matter’s with your known person on mutual basis.

Joint account’s can be open into any desired categories offered by numerous bank’s be it Current Account or Saving’s Account.

1. Understanding Joint Bank Accounts

A joint bank account is a financial account held by two or more people, allowing all account holders equal access to the funds within it. This shared ownership can be beneficial for various purposes, including:

i) Couples:

To manage shared expenses, like bills, rent or mortgage payments, and savings

goals.

ii) Business Partners:

For business transactions, managing company finances, or separating

business and personal funds.

iii) Family Members:

To assist aging parents, save for family vacations, or pool resources for

common expenses.

2. Choose the Right Bank and Account Type

While opening a joint bank account selecting the right financial institution and account type is

paramount. Consider factors such as location, fees, and the features offered by different banks.

Common types of joint accounts include:

Savings Accounts: Ideal for saving jointly for future goals.

Checking Accounts: Suited for managing everyday expenses and bills.

Investment Accounts: For jointly investing in stocks, bonds, or other securities.

3. Gather Required Documentation

To open a joint bank account, you’ll typically need to provide certain documents and information.

This may include:

i) Identification: Valid IDs for all account holders, such as passports, driver’s licenses, or

social security numbers.

ii) Proof of Address: Utility bills, rental agreements, or other documents showing your

address.

iii)Social Security Numbers: For tax reporting purposes.

iv) Employment Information: Including income details if required by the bank.

Ensure you check with the specific bank you choose for their exact requirements, as they may vary.

4. Visit the Bank in Person or Apply Online

Educate yourself on your bank’s policies, you can either visit a branch in person or apply online to

open a joint account through digital banking. If you opt for an online application, be prepared to submit scanned copies of the required documents.

5. Complete the Application Form

You’ll need to fill out an application form, whether you’re applying in person or online. Provide

accurate and complete information, as this will be used to verify your identity and set up the account.

6. Decide on Account Ownership Structure

When opening a joint bank account, you’ll need to determine what type of operating instruction you need to opt that best suits your requirement. There are mainly two common options that are widely selected from Joint bank Account opening by account holder’s:

Either or Survivor: In this type of account, if one account holder passes away, the remaining holder(s) automatically inherit the funds without the need for probate.

Jointly by all: Each account holder has a specified share of the funds, and their

portion can be passed to their heirs if they pass away after fulfillment of legal procedures.

Discuss with your co-account holder(s) and choose the option that best suits your needs.

7. Deposit Funds

An initial deposit will have to be made to activate your joint account This can be done in various

ways, including cash, checks, or electronic transfers from another account.

8. Set Up Online Banking

Register for online access and take advantage of features like online bill payment, account

statements, and fund transfers. Most banks offer online banking services, which make managing

your joint account more convenient.

9. Establish Clear Communication

Establish ground rules for how the account will be used, who is responsible for what expenses, and how you’ll track transactions. Effective communication is crucial when managing a joint account.

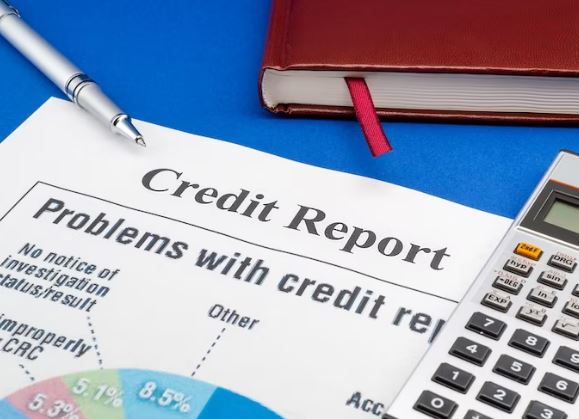

10. Monitor Account Activity Regularly

Set aside time each month to review account statements and verify that all transactions are

accurate. Periodically monitoring your joint account is essential to detect any discrepancies or

unauthorized transactions promptly.

11. Discuss Financial Goals and Budgeting

Discuss and create a budget that outlines your shared expenses, savings objectives, and any

financial milestones you want to achieve together. Use your joint account as a tool for achieving

common financial goals.

12. Address Disagreements and Changes

Disagreements can arise, especially when managing joint finances. It’s crucial to address any issues promptly and openly. Consider setting up regular meetings to discuss financial matters and any necessary adjustments to your account management strategy.

13. Plan for Contingencies

Life is unpredictable, and it’s essential to plan for various scenarios, such as divorce, the death of a co-account holder, or changes in financial circumstances. Consult with a financial advisor or attorney to understand the legal implications and options available in such situations.

14. Closing a Joint Account

If you need to close a joint account, all account holders must agree to the closure and will have to visit the concerned branch. Withdraw or transfer the remaining funds, and notify the bank in writing of your intent to close the account.

15. Legal Considerations

Understanding the legal implications of a joint account is vital. Consult with a legal expert or financial advisor to ensure you are aware of your rights and responsibilities as a joint account holder.

Read also :

Conclusion:

In conclusion, opening and operating a joint bank account can be a valuable financial tool for shared financial goals and responsibilities. However, it requires clear communication, trust, and effective management to ensure a smooth financial partnership. By following the steps outlined in this guide and staying informed about your account’s terms and conditions, you can make the most of your joint bank account while avoiding common pitfalls.